About FMC Financial Services, Inc.

Introduction

Small businesses comprise 90% of 30,000,000 businesses in the United States, create 60% of all new jobs, contribute to 55% of the United State’s GNP, and pay 70% of the federal taxes. While FMC Financial Services, Inc. (FMC) focused on the needs and solutions for small businesses, it became obvious that there were two other external components necessary for a company’s success; banking and accounting. Whereas a small business sells services and products, a bank sells money, and an accounting firm sells reporting used for bank loans and company decisions. From its beginning in 1978, FMC has developed various approaches for growing small businesses.

The successes of a small business owner, a banker, and CPA are connected and interrelated in such a way that each depends on the other for their success. For example:

a. A small business owner will often seek financing critical for their growth from a bank, primarily a community bank that grows its loan portfolios and profits by lending to businesses.

b. Accounting is the corner stone of financial language that bridges the communication gap between banks and business owners.

c. CPAs need business clients to grow their practices.

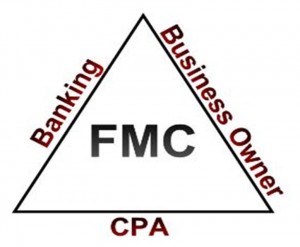

As each recognizes their success is dependent on each other’s success, the potential for growth can flourish. FMC refers to this as the Triangle of Business Growth© which is depicted below.

FMC Triangle of Business Growth©

Challenge

Although small businesses, bankers, and accountants are interdependent on one another for growth, they do not use the same terminology, resulting in poor communication. The reason is that each has developed their “own” language which is based on their different frames of reference and objectives. The small business owner is trying to grow and increase the wealth of his or her company; the banker is obligated to protect the depositors, shareholders and comply with banking regulations; and, the accountant most often is trying to reduce the business owner’s taxes, thereby reducing or eliminating business profits. Because of these differences, conflicts arise stifling growth for each party as well as undermining the opportunity to maximize overall business growth.

Solution

FMC has developed individual value propositions and services specific to small businesses, banking, and accounting that will maximize the overall growth for each business.